The key to unlocking Gen Z engagement in superannuation

In September 2021, a study revealed that a quarter of Australians worry more about money than anything else – yet over two-thirds don’t know their superannuation balance. It also found that only 18% of Australians aged 18 to 24 expect to rely on the Age Pension, indicating that Gen Z could be overconfident about their financial futures. But it’s not that young people aren’t generally engaging with their finances: Canstar’s 2021 Consumer Pulse Report found that Gen Z is actually leading the financial self-help movement, with just under two-thirds (65%) of Gen Z choosing to educate themselves on personal finance. When it comes to young people’s engagement with their super, one thing is clear: the issue is anything but black-and-white.

At Conduct, we thrive on complex problems. We’ve helped the DHHS make their digital experiences more accessible to the public. We’ve worked with Medibank to connect customers with healthcare providers seamlessly. We’ve supported the Royal Children’s Hospital in managing patient anxiety before daunting imaging procedures. And in the world of superannuation, we’ve been researching: what are the hurdles preventing young people from taking control of their retirement funds? And how might we break down these barriers to increase engagement, help people secure their financial futures, and revolutionise the industry as we know it?

We’ve been exploring a series of solutions aimed at flipping traditional super platforms on their head. Super that feels urgent and exciting. Super that gives a crypto-like high. Super that’s social and enjoyable to manage. Super that lives up to its name.

Super that feels tangible today

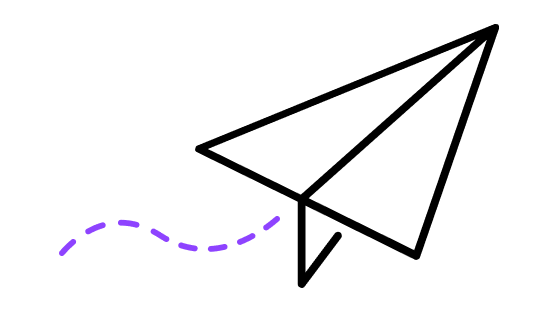

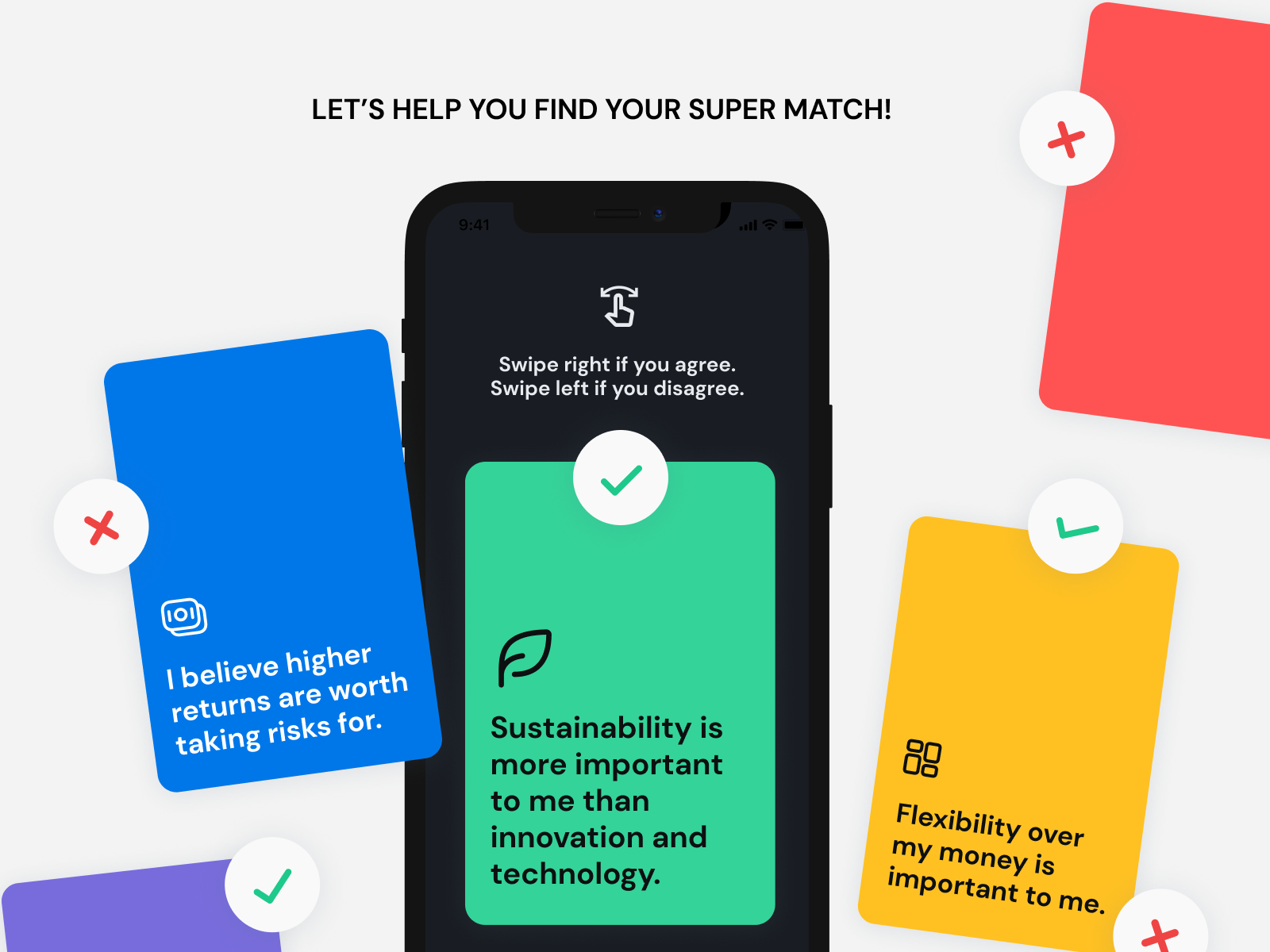

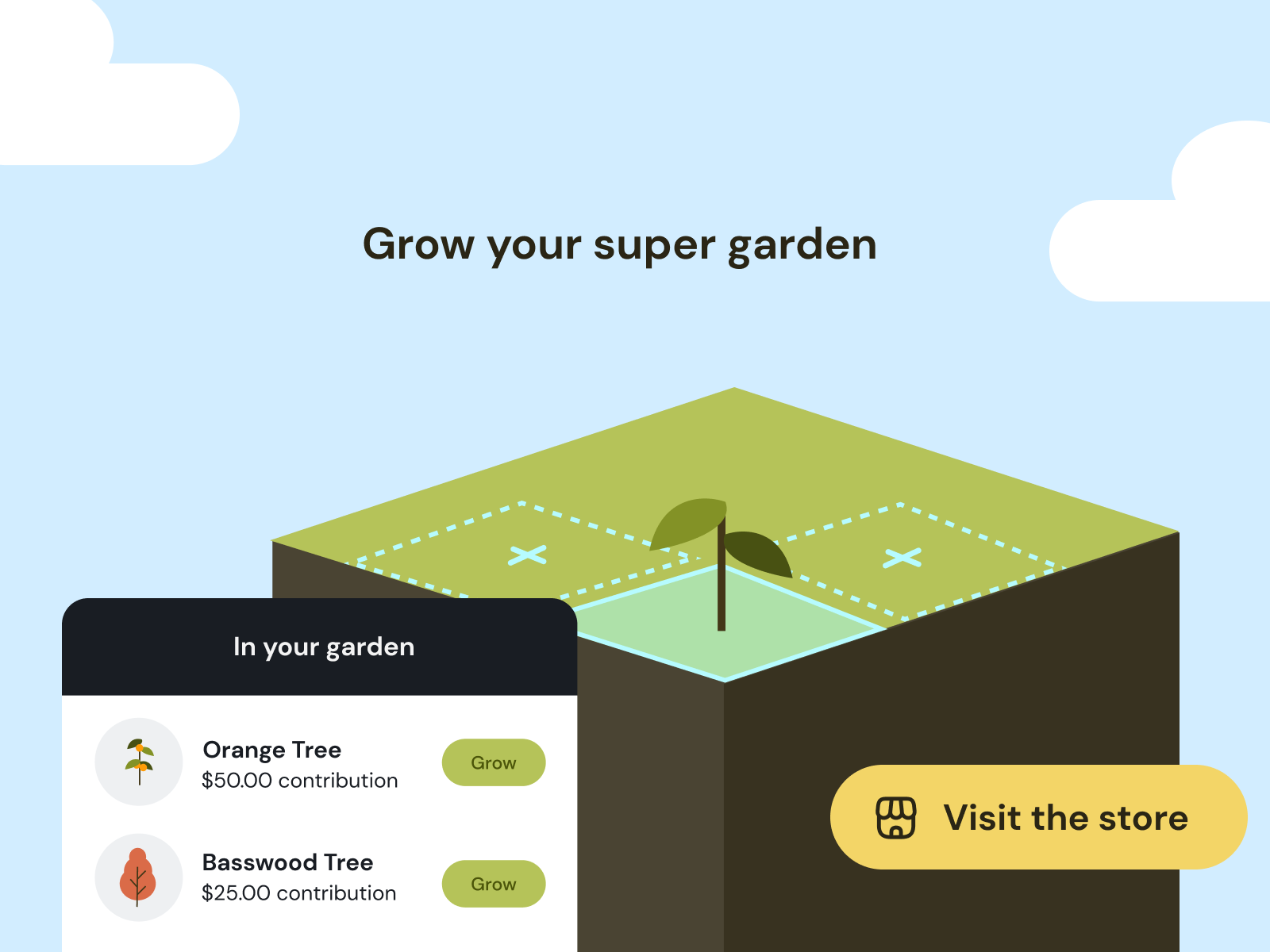

Our research shows that super falls into the ‘too-hard’ basket for many because it refers to an unpredictable future that feels out of reach. So we’ve been considering how to summon our financial futures into the present day, positioning super front-and-centre in customers’ minds.

One frequently under-utilised gateway is the user profile. What happens when members log in to their super fund’s online portal? Is it intuitive, easy to use, and interesting enough to warrant return visits? Is it tailored to the user’s line of work, lifestyle and unique needs? And how can we ethically leverage analytics and data to assist members with their super goals?

A visually captivating, multi-functional user dashboard is a vital component of success in super engagement. With the ability to view and make changes to their super funds in real-time, customers are more likely to feel in control of their super – and their future.

Super that’s as fun to manage as crypto

Real talk: For most people, superannuation is super dull. It’s technical, it’s paperwork, and it’s something we tend to put off thinking about until tax time. It’s not exactly what we chat about over beers at the pub – it’s not like crypto. So we’ve been asking ourselves: why not?

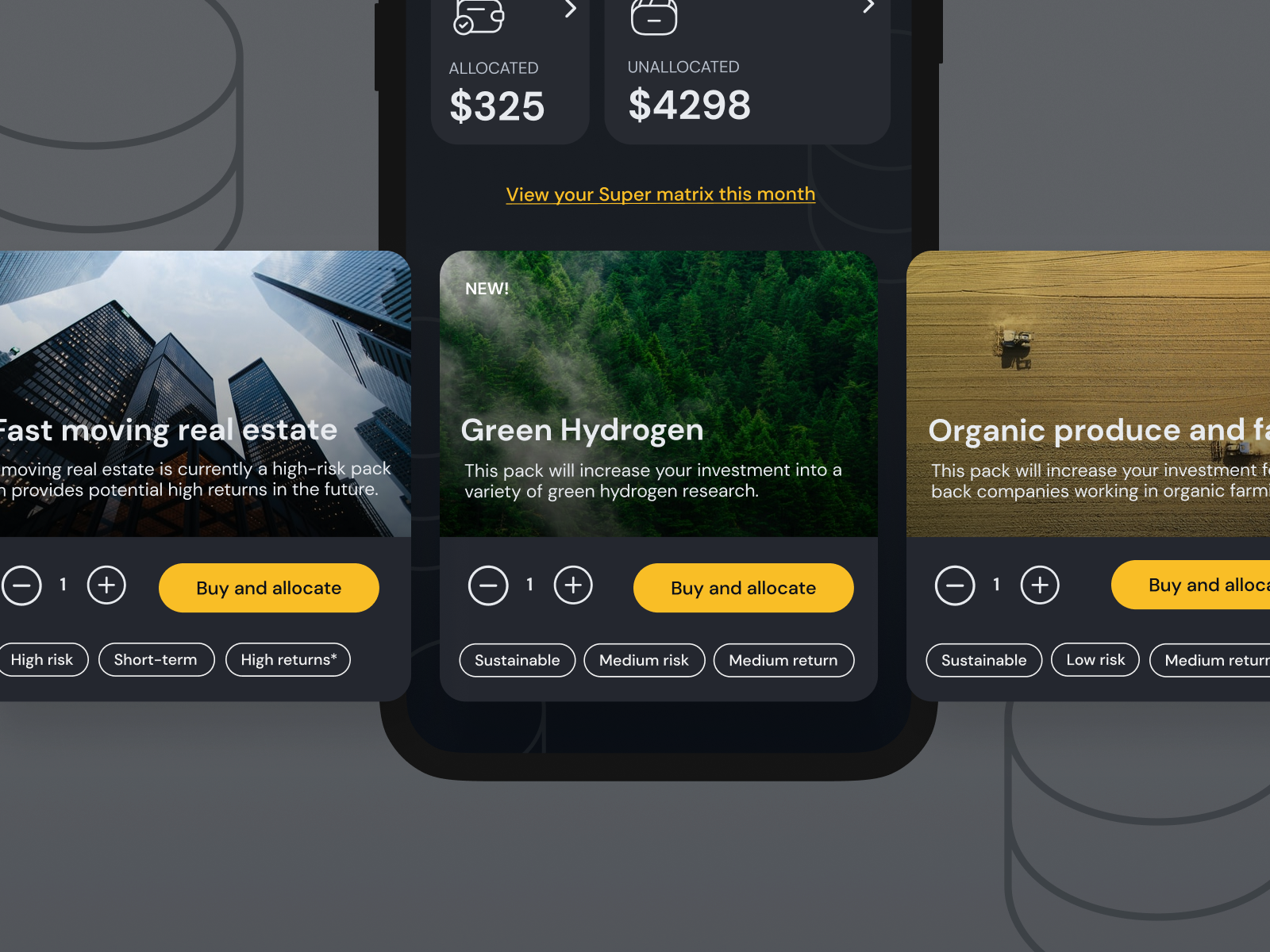

Super could be more than a ‘set and forget’ action each time we start a new job. What if we had a reason to check our accounts regularly? Could users be prompted each month to reprioritise their investments based on real-world data and current affairs? What if the world of super was so promising – and so dynamic – that we felt a crypto-esque high when managing our accounts?

At the core of this idea is a more dynamic approach to investment than super has traditionally entertained. After all, why shouldn’t super be playful, joyful and something to write home about?

Super that’s social

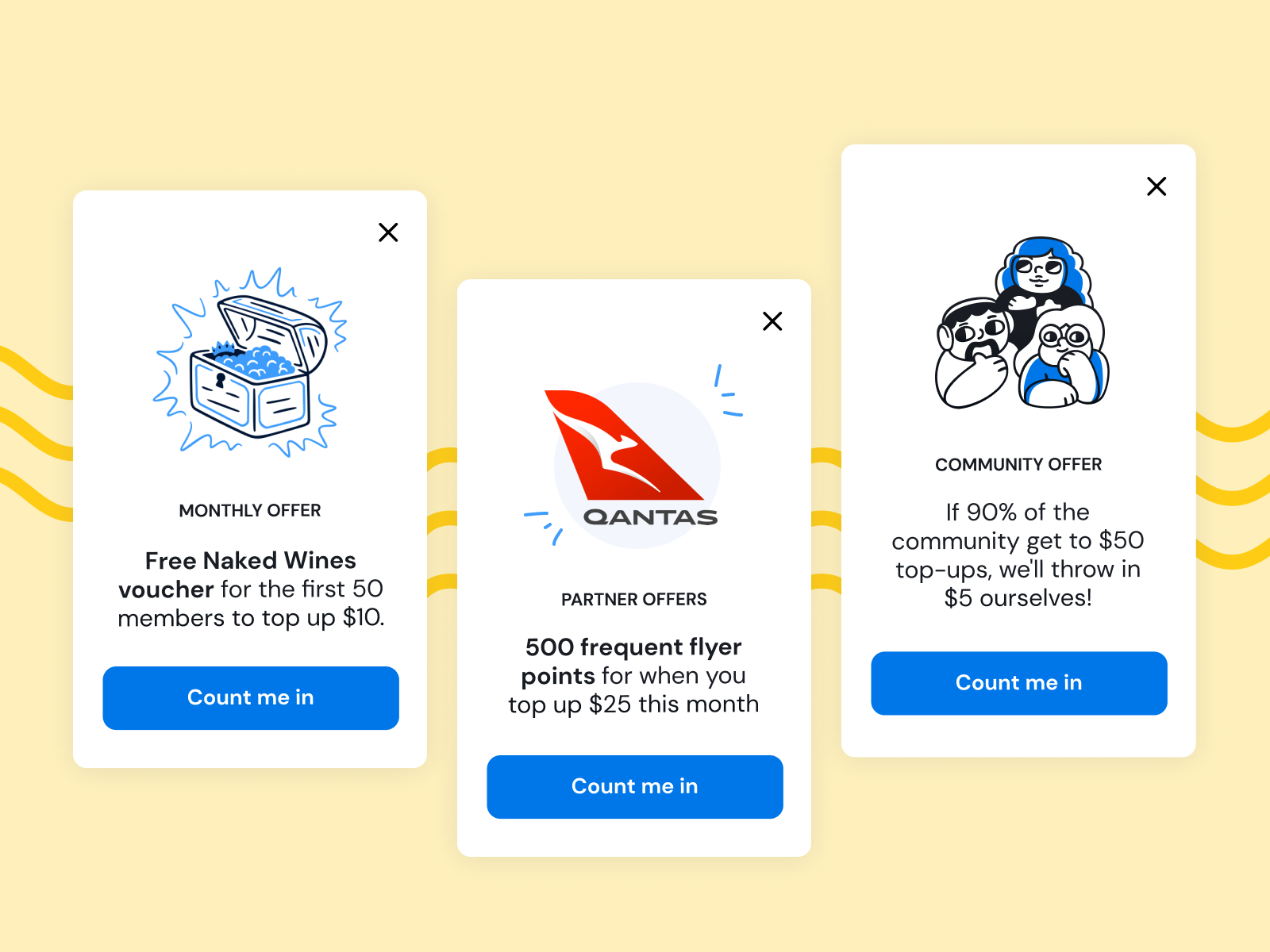

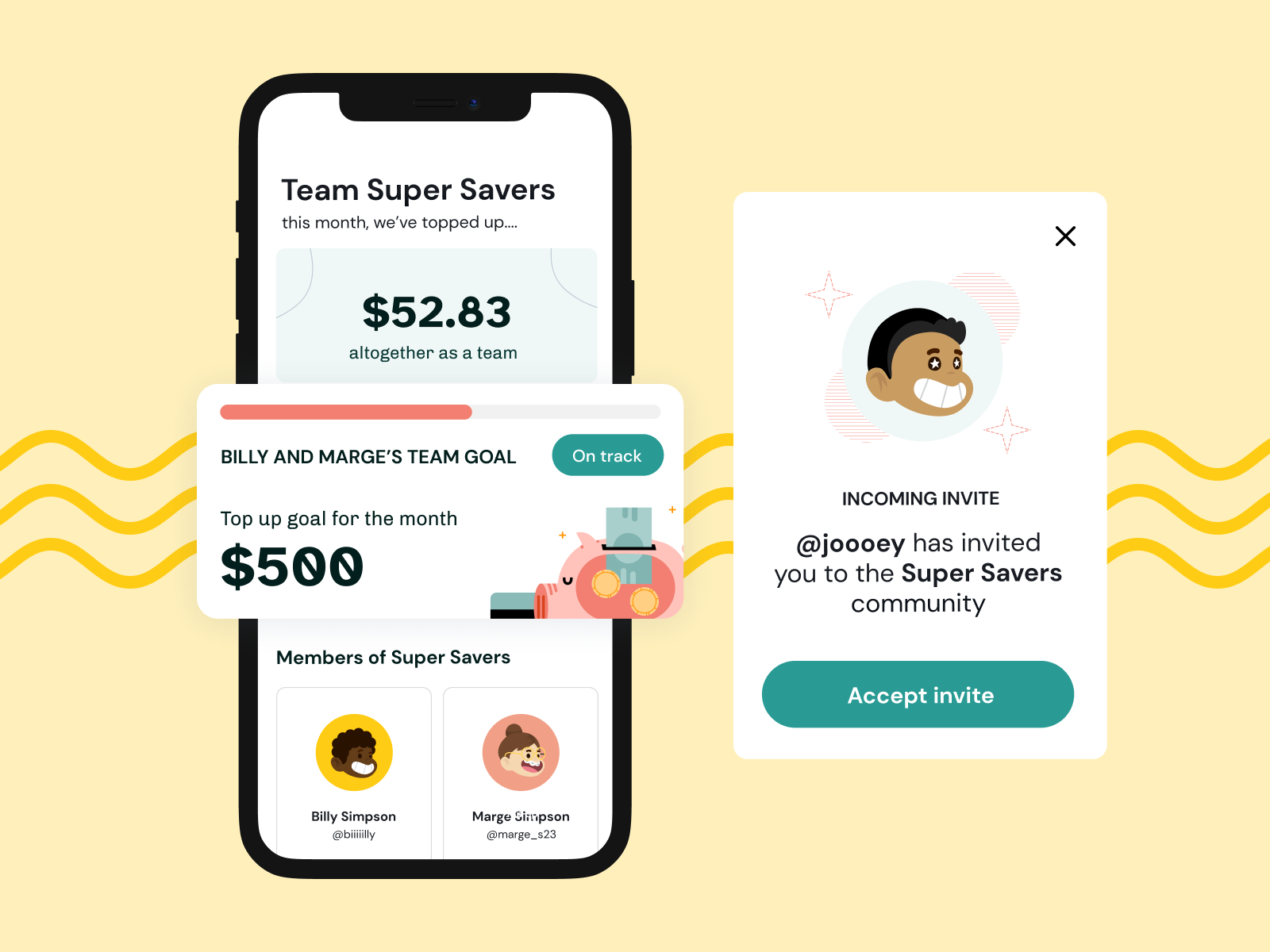

Social media is connecting superannuation members with their funds more than ever before. But what if the super experience was inherently social, too?

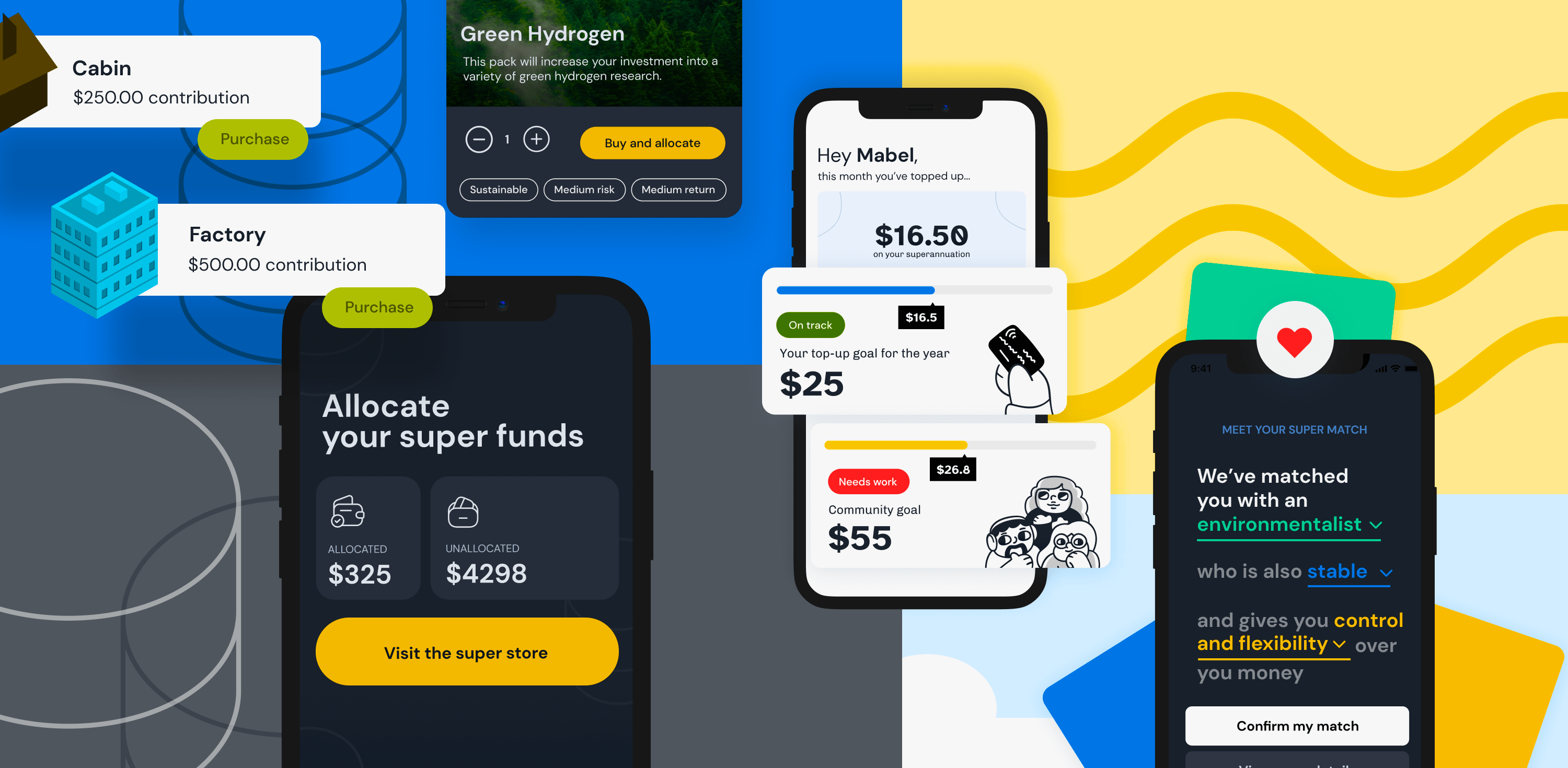

We’ve been exploring concepts for super platforms that turn managing our finances into a social activity. What if you could create shared goals between a private network of family and friends? What if your super fund could match you, dating app-style, with investments that match your goals and values? And what if your super funds could exist – and make an impact – in the metaverse?

Engaging customers through technology is more than clunky chatbots and established social media platforms. It’s about building social currency, increasing transparency, and giving customers the chance to assemble around their financial futures meaningfully.

Conducting the future of super

At Conduct, our agile way of working means the journey towards real-world solutions with real-life impact is always an iterative process – we’re constantly creating, testing, learning and improving. Behind this approach is a commitment to human-centred design, which, simply put, brings real people in for testing early in the process – and keeps them engaged throughout. When it comes to digital products, services, and the future of super, this way of working is the obvious choice.

Superannuation is a classic example of a longstanding, complex problem begging for a fresh perspective. With an emerging audience hungry for new ways to interact with their super, there’s a massive opportunity for the right fund to engage them. And we’re ready to lead the way.

We’re keen to change the industry for the better – and this was just a taste of our thinking so far. Interested in hearing more?

Get in touch with Charlie Pohl.More from the Journal